by Chelsea Brierton

Buying a home is both stressful and exciting, especially as a first-time homebuyer. As someone who has never been through the process, there can be a lot of questions and concerns for what’s to come.

Reviews.com interviewed experts and dug into the details so that you can know what to expect from the moment you start looking to closing day:

The “Just Looking” Stage

The ultimate question to consider in the “Just Looking” stage is, “Is it the right time to buy?” Analyzing the factors that go into proper timing will help you decide whether or not you’re in the right position to buy a house. Ask yourself these questions when you’re contemplating this stage:

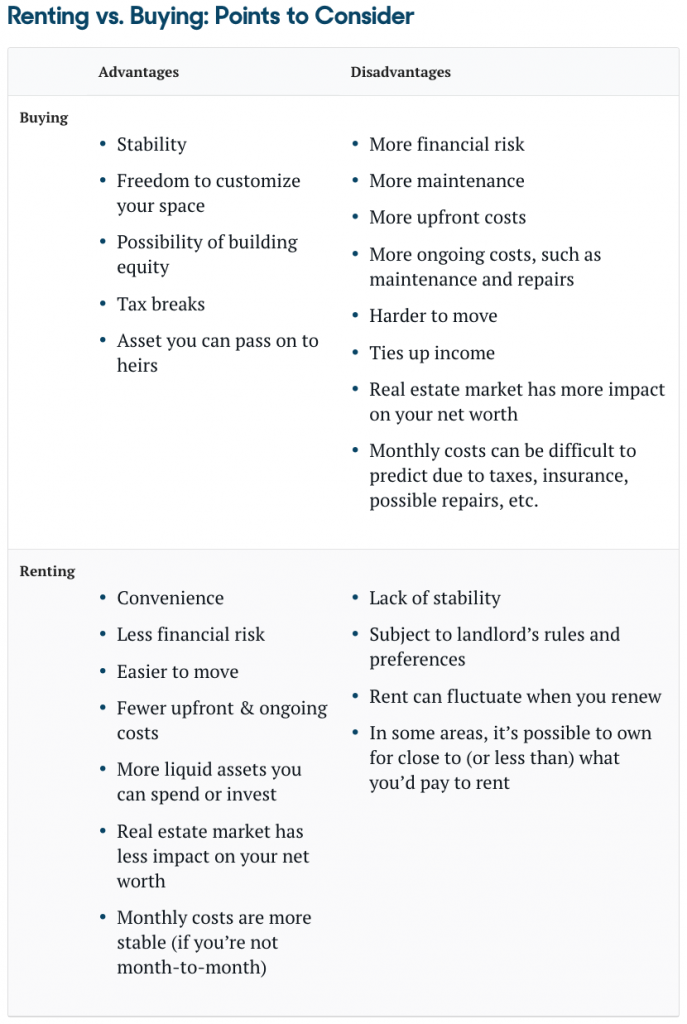

Should I rent or buy?

- What does my income look like now and in the future? Since most mortgages are 30-year fixed-rate, this expense will be in your life for quite some time. Consider if you can make your payments on one income (if you’re currently in a two-income situation), particularly if you’re planning on having kids or taking time off of work for an extended period of time.

- Am I happy where I am for a while or will I want to move in the future? Experts agree that most buyers must make mortgage payments for at least five years in order to break even and not lose money if they want to sell.

- What’s my credit score? Typically, the better your credit score, the better your loan APR. Even a 10 point increase on your credit score could mean thousands saved on interest over the course of your home loan. Consider making changes if you fall into a low credit bracket.

- What does the market look like? The desire to finally be a homeowner can be overwhelming, and cause buyers to choose homes that are outside of their price ranges. Is it possible that the buyer’s market will be more favorable even a few months from now? If so, consider waiting — it can save you thousands in the end.

If you can answer these questions feeling confident about where your future is going, it might be time to move on to stage 2.

The “Getting Ready to Buy a Home” Stage

So you’re ready to buy a home. Be prepared to get everything organized and in order for when you find your dream home and are ready to submit an offer.

- Prepare your finances

This means credit score, budget, the down payment you’re willing to put down, and finding any assistance programs to help you financially.

- Find a mortgage

Research mortgage types out there because the one you choose will determine what interest rate you receive, the downpayment size, and more. There are government-insured home loans backed by the FHA, USDA, and VA; adjustable-rate, fixed-rate, and interest-only conventional mortgages; and others.

- Narrow your search

Make a list of all the qualities you want in that perfect home. What neighborhood(s) do you want to live in? What are your non-negotiables? What are you willing to compromise on?

- Find an agent

This one is important. Your agent is the one you will consult throughout this process, so finding the right one who has your interests in mind is important. Seek referrals from friends, and don’t be afraid to interview a few to find the right one for you.

- Avoid common pitfalls

Learn from the mistakes of others. Hindsight is 20/20 after all, and learning from others’ experiences will help you in your home buying journey. See the full article to read what experts say are common mistakes first-time homebuyers make.

The “Buying & Closing” Stage

How do you buy a house? There are a few steps you’ll follow in order to secure your future home.

1. Consolidate your funds.

You’ll want to have all your (financial) ducks in a row to be able to pay a large amount of money upon closing. If you plan to use money gifted to you from friends or family for your down payment, you’ll need a Gift Letter to accurately show underwriters where the money came from.

2. Submit an offer

Congrats! You’re ready to submit your offer, which includes information about the home, your finances, earnest money and down payment, contingencies, and your expected closing date.

3. Arrange for inspection and appraisal

The appraisal process is a way for your lender to understand the home’s value. This is important because homes which sell for more than they’re worth are more likely to go underwater if the market falls.

Your home inspection is a way to identify the flaws in the property. If issues with the property come to light which hasn’t already been disclosed, you’ll negotiate a way to address them (buying “as-is” with a different price, requesting that the seller make the repairs, or backing out of the deal altogether)

4. Get a final loan approval

This is when the lender takes a closer look into your finances to ensure you’re in a good financial spot for the loan.

5. Purchase homeowners insurance

This might seem like a strange step to have to take before you close, but lenders require proof of homeowners insurance before your loan can be finalized. Be sure to compare rates, even if you’re eager to close and move in.

6. Close

Three business days after you close, you’ll get a closing disclosure, which tells you the final numbers of your purchase. Make sure you point out any last-minute corrections or changes. Congratulations, you did it!

The “Settling-In” Stage

Congratulations! You are a homeowner! It’s quite an exciting feeling, but there are many moving parts in this stage of the process — E.g. yourself. Here are some things to consider:

- A moving company

- Switching your services

- Protecting your investment

- Forwarding your mail

- Requesting new auto insurance quotes

You can read the full Ultimate Guide to Buying Your First Home here: https://www.reviews.com/blog/ultimate-guide-buying-first-home/

2 comments

Comments are closed.